What is the difference between sales tax and VAT 2024

Sales tax and VAT (Value Added Tax) are two common consumption taxes that governments use to generate revenue. While they both ultimately affect the price consumers pay for goods and services, they differ in how they are collected and administered. Understanding these distinctions can be crucial for businesses operating across borders and for consumers who want to be informed about their tax burden. The Key Distinctions: Here are some resources for further reading: Understanding the distinctions between sales tax and VAT can be advantageous for businesses involved in international trade and for consumers who want to make informed purchasing decisions. ALSO READ Key dates for small business owners in 2024

Understanding Input VAT and Output VAT in 2024

Input VAT and Output VAT in 2024: For businesses operating in countries with a Value Added Tax (VAT) system, navigating the complexities of input and output VAT is crucial for accurate tax filing and maintaining healthy cash flow. This blog post aims to demystify these terms and explain their significance in the context of 2024. What is Input VAT? Input VAT refers to the VAT paid by a business on its purchases of goods and services used for business purposes. This includes VAT on supplies like equipment, inventory, and services like rent and utilities. Businesses can typically reclaim this VAT on their VAT return, effectively reducing their overall tax liability. What is Output VAT? Output VAT, on the other hand, refers to the VAT charged by a business on its sales of goods and services. This is the amount added to the price of your products or services and collected from your customers. It’s important to note that you are merely acting as a collector for the tax authorities and must eventually remit the collected VAT. Key Points to Remember: Staying Updated: VAT regulations can change over time, so it’s crucial to stay updated on the latest rules and rates in your specific country. Consulting with a tax professional is highly recommended for businesses seeking in-depth guidance on VAT compliance. Official Links: By understanding the distinction and significance of input and output VAT, businesses can ensure accurate VAT reporting, maximize input VAT recovery, and navigate the VAT system with greater confidence. ALSO READ A Comprehensive Guide for Value Added Tax (VAT) 2023

Self-Build Cost Calculator in 2024

Self-Build Cost Calculator in 2024: Planning Your Dream Home: Building your own home can be a fantastic way to achieve your dream living space, tailored to your specific needs and preferences. However, navigating the financial aspects of a self-build project can be daunting. This is where a self-build cost calculator comes in handy. What is a self-build cost calculator? A self-build cost calculator is a tool that helps you estimate the total cost of building your own home. These calculators typically consider various factors that can impact the final cost, such as: How to use a self-build cost calculator: While self-build cost calculators cannot provide an exact price due to the numerous variable factors involved, they can offer a valuable starting point for your budgeting process. Here’s how to use one: Benefits of using a self-build cost calculator: Here are some resources with self-build cost calculators to get you started: Remember, a self-build cost calculator is just one tool in your self-build journey. Consulting with experienced professionals like architects, builders, and quantity surveyors is crucial for obtaining a more accurate and comprehensive cost estimate for your specific project. ALSO READ: Value Added Tax Helpline Office in 2024

5 Best VAT Calculators for the UK

Calculating Value Added Tax (VAT) in the UK can be a daunting task, especially with different rates and regulations. Whether you’re a small business owner, freelancer, or simply need to calculate VAT for personal purchases, online calculators can be a lifesaver. Here are five of the best VAT calculators for the UK in 2024: 1. VAT Calculator UK (vatcalcuk.com) This user-friendly website offers a simple yet effective VAT calculator. Enter your price, choose “Add VAT” or “Remove VAT,” and get the result instantly. Its clean interface and lack of additional features make it perfect for quick and easy calculations. 2. FreshBooks VAT Calculator (https://www.freshbooks.com/en-gb/hub/taxes/how-to-complete-a-vat-return) FreshBooks, a popular accounting software provider, offers a robust VAT calculator with both basic and advanced features. You can choose from various VAT rates, calculate VAT on multiple items, and even estimate the VAT impact on your business profits. 3. VATCalculatorUK.co.uk This comprehensive website provides various VAT tools, including a calculator, rate guide, and informative resources on various VAT-related topics. Their calculator caters to diverse needs, allowing you to handle calculations like VAT on margins, reverse VAT, and VAT on specific goods based on their VAT category. 4. VCO VAT Calculator (vatcalculators.online) This calculator stands out for its user-friendly interface with clear instructions and automatic updates as you enter values. It also offers a unique “reverse VAT calculator” function, helping you find the net price (excluding VAT) when you only know the price including VAT. 5. Sleek VAT Calculator (https://sleek.com/uk/) While not yet updated for 2024, Sleek’s VAT calculator remains a valuable resource. It offers basic VAT calculations alongside informative guidance on VAT rates and regulations in the UK. Additionally, their helpful guide on calculating and adding VAT can be beneficial for understanding VAT fundamentals. Remember, these calculators are helpful tools, but they shouldn’t replace official resources or professional advice for critical business decisions. Always refer to the UK government’s official website (https://www.gov.uk/government/organisations/hm-revenue-customs) for the latest VAT rates and regulations, and seek professional guidance for complex VAT matters. ALSO READ

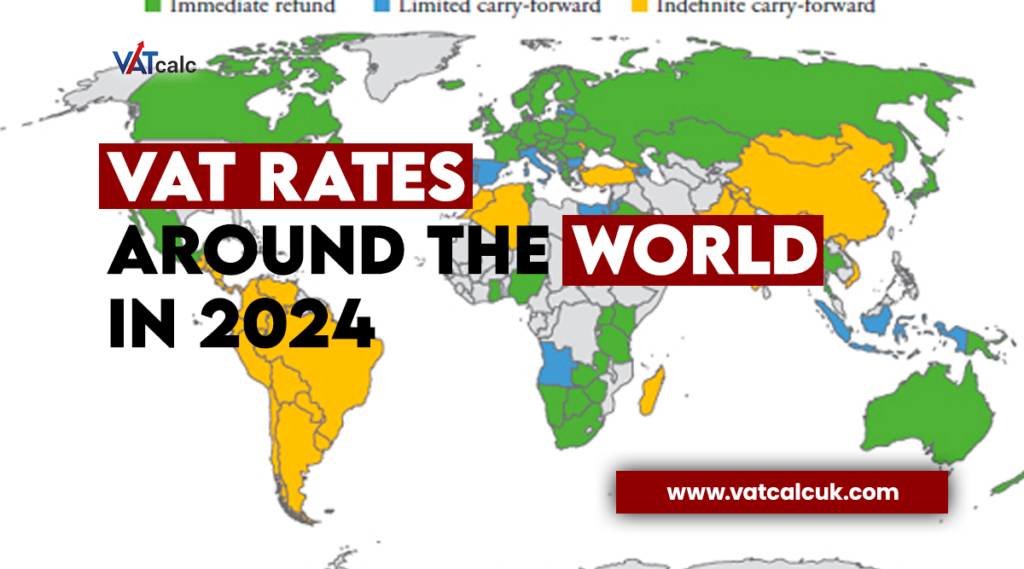

VAT Rates Around the World in 2024

VAT Rates Around the World in 2024: Value-added tax (VAT), also known as goods and services tax (GST) in some countries, is a consumption tax levied on the incremental value of goods and services at each stage of production and distribution. For businesses operating internationally, understanding VAT rate is crucial for accurate pricing, budgeting, and tax compliance. However, with different countries implementing diverse rates and structures, navigating this landscape can be confusing. This blog aims to simplify the process by providing an overview of VAT rates around the world in 2024 and offering resources for further exploration: Global VAT Landscape: Resources for further information: Remember: By understanding VAT implications, businesses can navigate international transactions with greater confidence, ensuring accurate pricing and compliance with regulations in different jurisdictions. ALSO READ Student Loan Forgiveness in the UK 2024

Small Firm Growth and the VAT Threshold Evidence

Does the VAT Threshold Hinder Small Business Growth in the UK? The recent International Monetary Fund (IMF) working paper, “Small Firm Growth and the VAT Threshold: Evidence for the UK,” explores a critical question for small businesses: does the VAT threshold act as a barrier to growth? The answer, based on the study’s findings, is somewhat nuanced. Key Takeaways: Implications: These findings suggest that the current VAT threshold might have unintended consequences for small businesses trying to scale up. The slowdown in growth can potentially impact their ability to invest, hire, and ultimately contribute to the overall economy. Further Exploration: The full paper can be accessed through the IMF website: Small Firm Growth and the VAT Threshold Evidence for the UK: [invalid URL removed] Understanding the impact of the VAT threshold on small businesses is crucial for policymakers considering potential reforms. Additionally, here are some official resources relevant to this topic: This blog post aims to provide a concise overview of the research and spark further discussion regarding the VAT threshold’s impact on small business growth in the UK. ALSO READ Norway VAT Changes in 2024

How Your Small Business Should Manage VAT in 2024

Mastering the Maze: How Your Small Business Should Manage VAT in 2024 Value Added Tax (VAT) can be a complex beast, especially for small businesses navigating the ever-changing regulations. But fear not! With the right strategies and understanding, you can keep your VAT management running smoothly in 2024. This blog post will equip you with the knowledge and essential resources to effectively handle your VAT obligations. Key Considerations for 2024: Official Resources and Tools: Effective Management Strategies: Remember: VAT compliance is not optional. By taking a proactive and informed approach, you can ensure your small business avoids unnecessary penalties and complications. Utilize the resources provided, adapt your strategies to your specific needs, and don’t hesitate to seek professional help if needed. By staying organized, compliant, and adaptable, you can turn VAT management from a burden into a manageable aspect of your business operations. Disclaimer: This blog post is for informational purposes only and should not be construed as professional tax advice. Please consult with a qualified tax advisor or accountant for guidance specific to your business and applicable regulations. ALSO READ VAT guide (VAT Notice 700)

What is the Annual Accounting VAT Scheme?

Breathe Easy! Simplify Your VAT with the Annual Accounting Scheme: For many small businesses, dealing with VAT can feel like a constant administrative headache. Quarterly returns, payments, and record-keeping can eat into valuable time and resources. But what if there was a way to simplify your VAT experience? Enter the Annual Accounting VAT Scheme, a lesser-known option that could be a game-changer for your business. So, what exactly is the Annual Accounting VAT Scheme? Instead of the standard four VAT returns and payments per year, this scheme allows you to: Who is eligible for the scheme? This scheme is open to: However, some exclusions apply: What are the benefits of using this scheme? Are there any drawbacks to consider? Interested in learning more? Here are some official links to help you decide if the Annual Accounting VAT Scheme is right for you: Remember, before joining the scheme, carefully consider your circumstances and consult with a financial advisor if needed. By understanding the Annual Accounting VAT Scheme, you can make an informed decision and potentially streamline your VAT experience, freeing up your time and resources to focus on growing your business. ALSO READ How does VAT (Value Added Tax) Work?

Suspension of VAT on New Houses to Continue till 2024

Suspension of VAT on New Houses: In a move aimed at boosting the housing market and providing relief to homebuyers, the government has announced the extension of the suspension of Value Added Tax (VAT) on new houses until 2024. This decision comes as welcome news for both prospective homeowners and the real estate industry, offering a significant incentive for individuals looking to purchase a new property. Let’s delve into the implications of this extension and what it means for the housing sector. Background:As part of the government’s efforts to stimulate the housing market and promote homeownership. Under the scheme, buyers of newly built homes were exempt from paying VAT on the purchase price, providing a financial incentive for individuals looking to invest in property. Extension until 2024:The decision to extend the suspension of VAT on new houses until 2024 reflects the government’s continued commitment to supporting the housing sector and facilitating homeownership. By maintaining this incentive for another, the government aims to encourage more people to enter the property market and stimulate economic activity within the construction industry. Impact on Homebuyers:For prospective homebuyers, the extension of the VAT suspension represents a significant financial benefit. By exempting new homes from VAT, buyers can potentially save a substantial amount on their property purchase, making homeownership more accessible and affordable. This measure is particularly advantageous for first-time buyers and individuals looking to upgrade to a new property. Impact on the Real Estate Industry:The extension of the VAT suspension is also expected to have a positive impact on the real estate industry. By incentivizing the purchase of new homes, the measure is likely to spur demand for newly built properties, leading to increased sales and development activity within the sector. This, in turn, could contribute to job creation and economic growth, as well as provide a boost to related industries such as construction and home furnishings. Government Support:The decision to extend the suspension of VAT on new houses underscores the government’s commitment to supporting the housing market and driving economic recovery. By implementing targeted measures to stimulate demand and incentivize investment in the property sector, policymakers aim to create a conducive environment for sustainable growth and development. Official Links: In conclusion, the extension of the suspension of VAT on new houses until 2024 is a significant development that is expected to have far-reaching implications for both homebuyers and the real estate industry. By providing a financial incentive for individuals to invest in property, the measure supports the government’s broader objectives of promoting homeownership and stimulating economic growth. As the housing market continues to evolve, measures such as these play a crucial role in shaping its trajectory and ensuring its resilience in the face of economic challenges. ALSO READ A Comprehensive Guide for Value Added Tax (VAT) 2023

Can I Get Car Finance with an IVA in 2024?

Car Finance with an IVA in 2024: If you’re navigating financial challenges, such as an Individual Voluntary Arrangement (IVA), you might be wondering about your options for obtaining car finance. An IVA can impact various aspects of your financial life, including your ability to secure loans or credit. However, despite this hurdle, there are still avenues available for individuals with an IVA to access car finance in 2024. Let’s explore how you can navigate this process and find suitable financing options. Understanding an Individual Voluntary Arrangement (IVA): An Individual Voluntary Arrangement (IVA) is a formal agreement between you and your creditors to repay your debts over a specified period, usually around five to six years. It provides a structured repayment plan that aims to make your debt more manageable while preventing bankruptcy. While an IVA can offer relief from overwhelming debt, it also comes with implications for your credit rating and financial transactions. Car Finance Options with an IVA: Despite the financial challenges posed by an IVA, it’s still possible to obtain car finance. Here are some options to consider: Official Links for Further Information: Conclusion: While having an IVA can pose challenges when seeking car finance, it’s not necessarily a barrier to obtaining the vehicle you need. By exploring specialist lenders, guarantor loans, and alternative finance solutions, individuals with IVAs can still access car finance options in 2024. It’s essential to research and compare different lenders, understand the terms and conditions, and ensure affordability before committing to any finance agreement. Additionally, seeking advice from financial professionals or debt charities can provide valuable guidance in navigating the complexities of car finance during an IVA. ALSO READ Understanding the VAT Threshold Changes in the UK for 2024